Key Insights from the Latest CMO Survey

Discover key insights from the Fall 2024 CMO Survey by Duke, covering marketing budget trends, martech investments, and the revival of traditional...

What SMB CEOs learned about marketing, and how to make FY26 the year of predictable growth.

By mid-2025, most SMB CEOs were looking at the same dashboard and asking the same question: why is growth costing more but delivering less?

Paid media prices rose. Conversion rates slipped. AI made marketing faster but not necessarily smarter. And buyers, flooded with synthetic content, became harder to convince and even harder to keep.

The old playbook — spend more to grow more — finally broke. 2025 taught CEOs two critical lessons: attention got expensive, and trust got priceless.

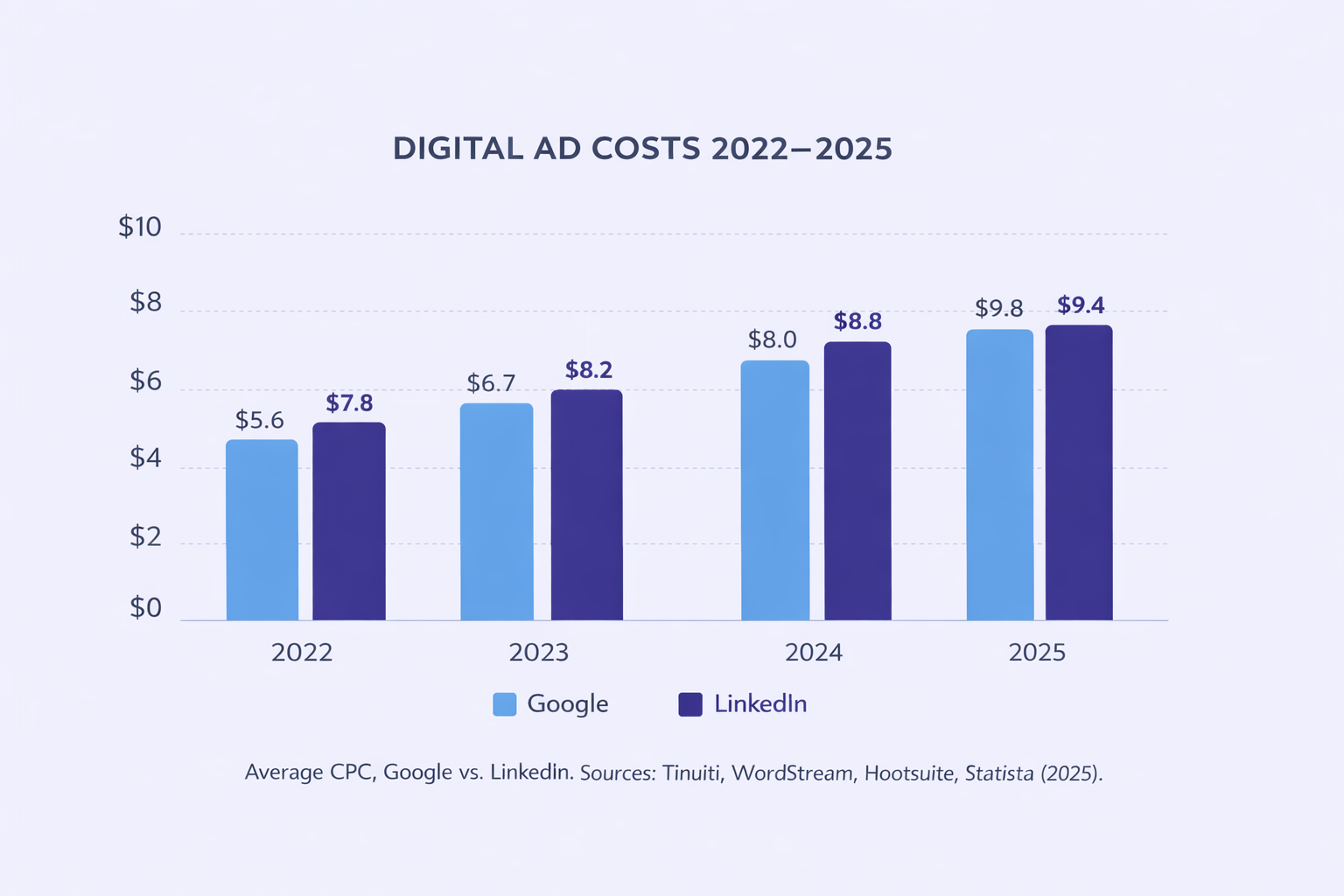

Across industries, digital attention became a premium commodity. Average digital ad costs rose again in 2025, with CPMs up nearly 15% and CPCs at record highs (Marketing Dive, 2025). For SMBs with tighter margins, that inflation hit hard.

A 2025 Blazeo report found small businesses spent an average of about $78K annually on marketing, yet most struggled to attribute spend to results (Blazeo, 2025). At the same time, B2B buyers consumed more information before talking to sales, 13 pieces of content on average (Scopic Studios, 2025).

That created a paradox: even as budgets rose, decision cycles lengthened. Attention wasn’t the growth lever anymore; clarity was.

The most efficient SMBs started pulling money out of performance channels and into owned media, partnerships, and customer advocacy, places where trust compounds and costs don’t.

One manufacturing SaaS client we worked with cut paid spend 20 percent and doubled its inbound pipeline by investing in referral programs and customer-led webinars. It wasn’t louder marketing; it was clearer marketing.

“You can’t outspend declining attention.”

If attention was expensive, trust became the real ROI. 2025 was also the year AI marketing hit saturation and backlash. Audiences began spotting “AI slop” instantly. Brands like Heineken and Polaroid leaned into “anti-AI” authenticity campaigns that won headlines and loyalty (Business Insider, 2025).

In B2B, leaders like HubSpot and Gong proved that trust scales faster than reach. Both built credibility through human-authored insights and transparent data storytelling — proof, not polish, became the new performance marketing.

HubSpot’s State of Marketing Report 2025 found that 44 percent of marketers made customer experience their top priority, and 96 percent said personalized, value-driven content increased sales (HubSpot, 2025).

The takeaway for CEOs: credibility compounds faster than clicks. Teams that prioritized clarity of story and measurable outcomes saw higher conversion and longer retention.

“The loudest brands burned fast. The trusted ones compounded.”

By late 2025, a pattern was clear: the fastest-growing SMBs weren’t the ones spending more; they were the ones aligning better.

Companies that tightly linked marketing, sales, and finance saw outsized results. Research shows that firms with strong sales-marketing alignment achieved 24 percent faster revenue growth and 27 percent higher profit growth, while well-aligned teams closed 38 percent more deals and generated up to 208 percent more revenue from marketing than peers (DreamFactory Agency, 2025; EasyWebinar, 2025).

Alignment looked less like meetings and more like shared accountability. Marketing stopped reporting on activity (leads generated) and started reporting on pipeline efficiency — cost per qualified opportunity. Brand teams focused on visibility within ICPs, not total impressions. Customer teams tracked retention velocity, how fast new revenue replaced what was lost.

When every team spoke the same metric language, growth became predictable and defendable.

“Alignment isn’t a soft skill. It’s a financial strategy.”

If FY25 was about recognizing why growth became expensive, FY26 is about making growth predictable again. This year, the best-performing SMBs won’t chase more marketing, they’ll engineer clarity.

Instead of “generate more leads,” define success by the levers that actually drive revenue:

When every OKR links directly to a financial driver, marketing stops being a department and becomes a system.

Most marketing budgets still read like menus, line items for social, events, or content. But CFOs and CEOs don’t fund activities; they fund results.

In FY26, treat every budget line like a hypothesis:

“If we invest X here, what measurable business result should it create, and how soon will we know?”

That reframes planning from inputs to outcomes such as:

The test of an outcome-based budget is whether each initiative links to one of those levers and has a clear feedback loop. When reviewing spend monthly or quarterly, don’t ask “what did we do?” — ask “what moved?”

If a tactic doesn’t move a measurable driver within a quarter, treat it like a failed experiment: adjust or reallocate. That discipline turns marketing from a cost center into a portfolio of bets with visible returns.

Alignment isn’t a meeting; it’s a management system. Run cross-functional reviews at a regular cadence (monthly or quarterly) where marketing, sales, and finance look at the same three charts: pipeline efficiency, brand visibility, and retention velocity.

No vanity metrics. No “what we tried.” Only what changed.

Over time, that rhythm creates compound clarity, and clarity compounds faster than capital.

Before next quarter’s planning session, ask your team one question:

Which three metrics tell us if growth is working before Finance does?

That question will tell you everything about your company’s alignment, and your potential.

Discover key insights from the Fall 2024 CMO Survey by Duke, covering marketing budget trends, martech investments, and the revival of traditional...

Outcome Marketing: A Proven Framework for Predictable Growth

Why More Tools Don’t Create Better Outcomes — Clarity Does At some point in every growing business, someone looks at the marketing tech stack and...